Looking back at our example from above, if we were to contribute an additional $100 per month into our investment, That can really boost the growth of your money in the longer term. Advertisements Compounding with additional depositsĬombining interest compounding with regular deposits into your savings account, SIP, Roth IRA or 401(k) is a highly efficient saving strategy The risk management strategy of diversification is The reality is that returns on investments will vary year on year due to fluctuations caused by economic factors. If you are investing your money, rather than saving it in fixed rate accounts, These example calculations assume a fixed percentage yearly interest rate. This means total interest of $16,532.98 and $10,000 invested at a fixed 5% yearly interest rate, compounded yearly, will grow to $26,532.98 after 20 years. We'll use a longer investment compounding period (20 years) at 10% per year, to keep the sumĪs we compare the compound interest line in our graph to those for standard interest and no interest at all, it's clear to see how compound interest Obvious when you look at a graph of long-term growth.īelow is an example graph of an initial $1,000 investment. I think pictures really help with understanding concepts, and this situation is no different. See also: Simple Interest Calculator | Loan Calculator With Extra Payments

#COMPOUND INTEREST CALCULATOR HOW TO#

How to use the formula step-by-step, and give some real-world examples of how to use it.įor the remainder of the article, we'll look at how compound interest provides positive benefits for savings and investments. In our article about the compound interest formula, we go through the process of Deduct the principal balance from your step 3 result if you want just the interest.Multiply your step 2 result by your principal balance (P).Raise the resulting figure to the power of the number of years multiplied by 12.

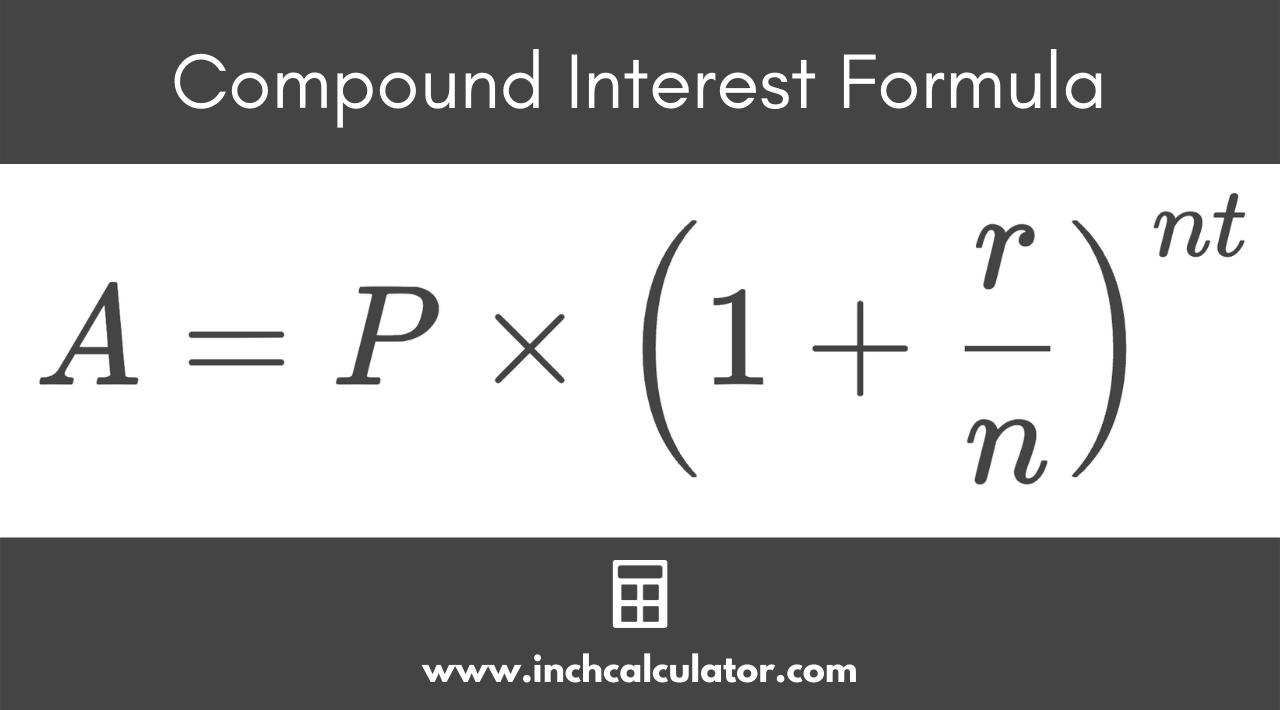

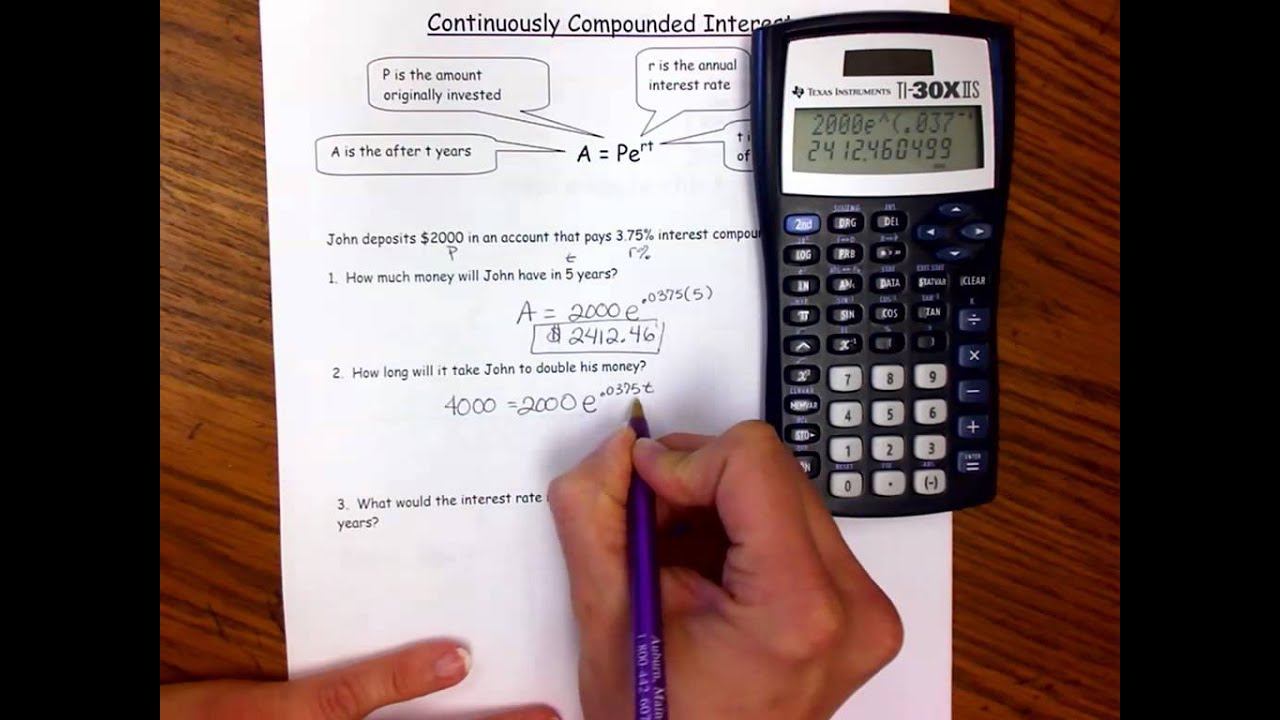

Divide your annual interest rate (decimal) by 12 and then add one to it.Means that our interest is compounded 12 times per year: Here's how to calculate monthly compound interest using our compound interest formula. n = number of times interest is compounded per yearĪdvertisements How to calculate monthly compound interest.Here’s a short video explaining how compound interest works… Highly effective growth strategy for accelerating the long-term value of your savings or investments. When you combine the power of interest compounding with regular, consistent investing over a sustained period of time, you end up with a The concept of compound interest, or 'interest on interest', is that accumulated interest is added back onto your principal sum, with future interestĬalculations being made on both the original principal and the already-accrued interest. You can include regular deposits or withdrawals within your calculation to see how they impact the future value. Simply enter your initial investment (principal amount), interest rate, compound frequency and the amount of time you're aiming to save or invest for.

With our compound interest calculator you can calculate the interest you might earn on your savings, investment or 401k over a period of yearsĪnd months based upon a chosen number of compounds per year.

0 kommentar(er)

0 kommentar(er)